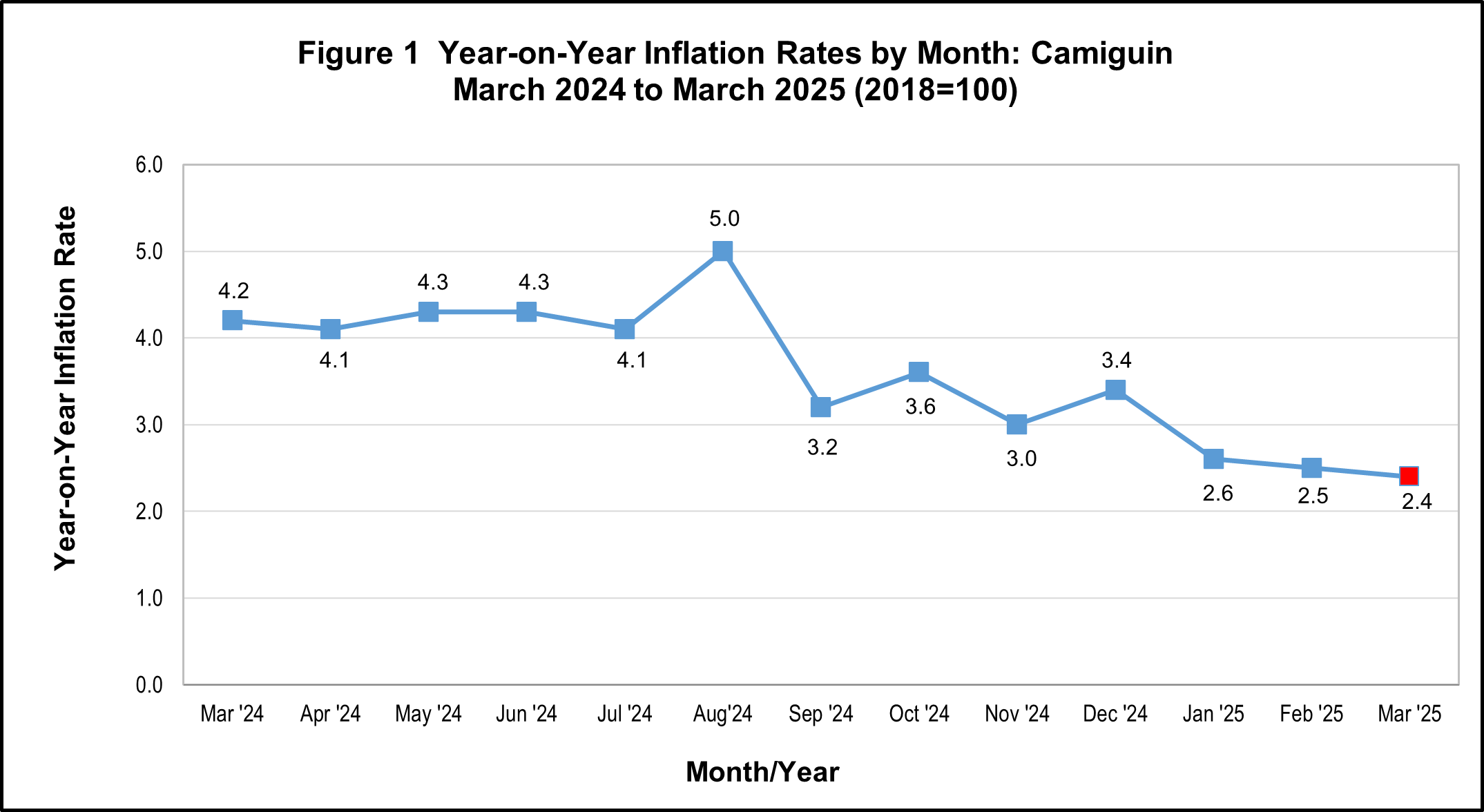

The inflation rate in Camiguin slowed down to 2.4 percent in March 2025

The inflation in Camiguin has a slower rate of increase of 2.4 percent in March 2025 from the 2.5 percent posted in February 2025. In March 2024, inflation rate was higher at 4.2 percent. The province's year-to-date inflation rate is at 2.5 percent. (See Figure 1)

Source: Survey of Retail Prices of Commodities for the Generation of CPI, PSA

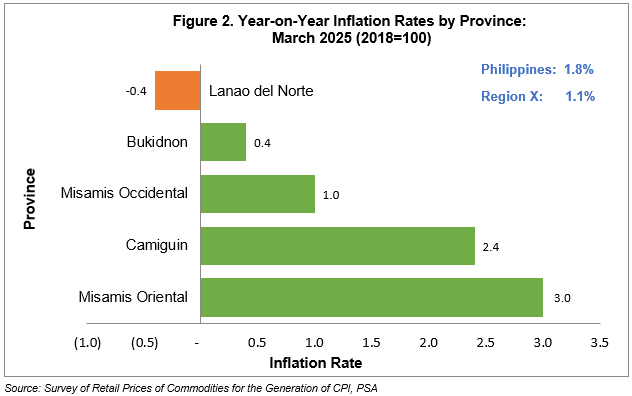

All provinces in Northern Mindanao registered a decrease in its inflation rates in March 2025. Notably, the province of Lanao del Norte recorded a 0.4 percent decline down by 0.6 percentage points from the 0.2 percent in February 2025.

Additionally, inflation rates in Bukidnon, Misamis Occidental, and Misamis Oriental decelerated to 0.4 percent, 1.0 percent, and 3.0 percent respectively. (See Figure 2)

Figure 2 presents the annual inflation rates of the provinces in Region X in March 2025.

Source: Survey of Retail Prices of Commodities for the Generation of CPI, PSA

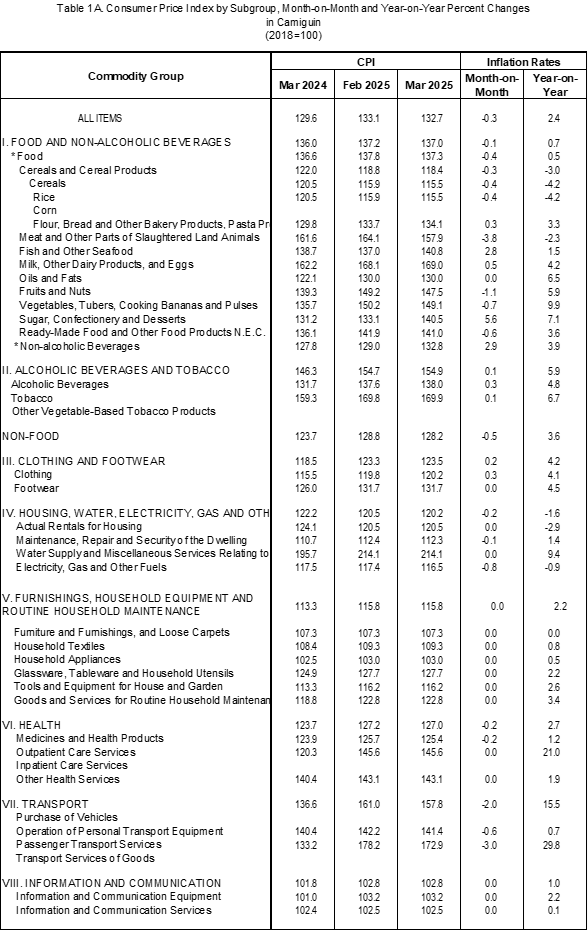

The slower increase of the annual inflation rate of the province in March 2025 was caused by slowdown in the following indices:

Alcoholic beverages and tobacco, 5.9 percent;

Furnishings, household equipment and routine household maintenance, 2.2 percent;

Heath, 2.7 percent;

Transport, 5 percent;

Recreation, sport, and culture, 1.7 percent;

Restaurants and accommodation services, 5.4 percent; and

Personal care, and miscellaneous goods and services, 1.8 percent.

Moreover, the same rate of decline in the inflation was posted in the index of housing, water, electricity, gas and other fuels at 1.6 percent.

On the contrary, the commodity groups of food and non-alcoholic beverages, clothing and footwear, and information and communication posted faster rate of increases with 0.7 percent, 4.2 percent, and 1.0 percent respectively.

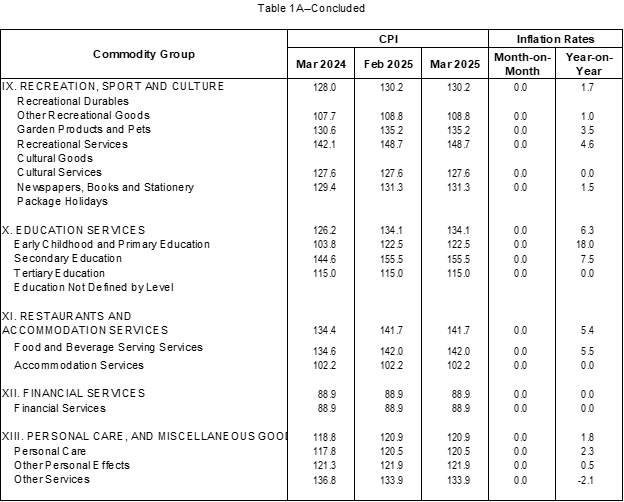

Furthermore, education and financial services maintained the same inflation rate as in February 2025. (See Table 1)

Table 1. Year-on-Year Inflation Rates by Commodity Group,

Camiguin (2018 = 100)

| Commodity Group | March 2025 | February 2025 | March 2024 |

| All Items | 2.4 | 2.5 | 4.2 |

| Food and Non-Alcoholic Beverages | 0.7 | 0.1 | 9.0 |

| Alcoholic Beverages and Tobacco | 5.9 | 6.8 | 8.9 |

| Clothing and Footwear | 4.2 | 4.0 | 5.3 |

| Housing, Water, Electricity, Gas and Other Fuels | (1.6) | (1.6) | (0.7) |

| Furnishings, Household Equipment, and Routine Household Maintenance | 2.2 | 2.6 | 3.1 |

| Health | 2.7 | 4.6 | 3.2 |

| Transport | 15.5 | 18.9 | (4.7) |

| Information and Communication | 1.0 | 0.8 | 0.4 |

| Recreation, Sports and Culture | 1.7 | 2.1 | 3.5 |

| Education Services | 6.3 | 6.3 | 0.7 |

| Restaurants and Accommodation Services | 5.4 | 6.7 | 2.1 |

| Financial Services | 0.0 | 0.0 | (11.1) |

| Personal Care and Miscellaneous Goods and Services | 1.8 | 2.2 | 2.5 |

Source, Survey of Retail Prices of Commodities for the Generation of CPI PSA

The acceleration of food in March 2025 was primarily brought about by increases in the following food groups:

Flour, bread and other bakery products, pasta products, and other cereals, 3.3 percent;

Fish and other seafood, 1.5 percent;

Milk, other products, and eggs, 4.2 percent;

Vegetables, tubers, cooking bananas and pulses, 9.9 percent; and

Sugar, confectionery, and desserts, 7.1 percent.

On the other hand, declines were registered in the indices of rice (4.2%) and meat and other parts of slaughtered land animals (2.3%).

Moreover, slower rate of increases was noted in the following food items:

Oils and fats, 6.5 percent;

Fruits and nuts, 5.9 percent; and

Ready-made food and other food products n.e.c., 3.6 percent. (See Table B and Table 1A)

Table B. Year-on-Year Inflation Rates by Food Group:

Camiguin (2018=100)

| Food Group | March 2025 | February 2025 |

*Food Cereals and Cereal Products Cereals Rice Flour, Bread and Other Bakery Products, Pasta Products, and Other Cereals Meat and Other Parts of Slaughtered Land Animals Fish and Other Seafood Milk, Other Dairy Products, and Eggs Oils and Fats Fruits and Nuts Vegetables, Tubers, Cooking Bananas and Pulses Sugar, Confectionery and Desserts Ready-Made Food and Other Food Products N.E.C. * Non-alcoholic Beverages | 0.5 (3.0) (4.2) (4.2) 3.3 (2.3) 1.5 4.2 6.5 5.9 9.9 7.1 3.6 3.9 | 0.0 (2.9) (4.2) (4.2) 3.0 (0.3) (2.3) 3.4 7.3 6.6 7.5 2.7 4.4 1.2 |

(SGD.)FRANCISCO C. GALAGAR, JR.

Chief Statistical Specialist

Technical Notes

This Special Release presents the results of the Survey of Retail Prices of Commodities and Services for the Generation of Consumer Price Index (CPI) conducted in March 2025.

CPI

The CPI is an indicator of the change in the average retail prices of a fixed basket of goods and services commonly purchased by households for their day-to-day consumption relative to a base year.

Uses of the CPI

As an indicator, the CPI is most widely used in the calculation of the inflation rate and purchasing power of the peso. It is a major statistical series used for economic analysis and as a government economic policy monitoring indicator.

The CPI is also used as a deflator to express value series in real terms, which is, measuring the change in actual volume of transactions by removing the effects of price changes. Another major importance of the CPI is its use as a basis to adjust wages in labor-management contracts and pensions and retirement benefits. The CPI also inputs wage adjustments through collective bargaining agreements.

Components of the CPI

a. Base Period

This is a reference date or simply a convenient benchmark to which a continuous series of index numbers can be related. Since the CPI measures the average changes in the retail prices of a fixed basket of goods, it is necessary to compare the movement in previous years back to a reference date at which the index is taken as equal to 100.

The present series uses 2018 as the base year. The year 2018 was chosen as the base year because it is the year when the Family Income and Expenditure Survey (FIES) was conducted. The FIES is the basis of the CPI weights.

b. Market Basket

Market basket refers to a sample of thousands of varieties of goods purchased for consumption and services availed by households in the country. It was selected to represent the composite price behavior of all goods and services purchased by the consumers.

c. Weighting System

The weighting system is a desirable system that considers the relevance of the components of the index. For the CPI, the weighting pattern uses the expenditures on various consumer items purchased by households as a proportion to total expenditures.

d. Geographic Coverage

CPI values are computed at the national, regional, and provincial levels, and for selected cities. A separate CPI for NCR is also computed.

e. Classification Standards

The 2012-based CPI series is the first in the series that used the 1999 United Nations Classification of the Individual Consumption According to Purpose (COICOP) in determining the commodity groupings of the items and services included in the market basket. The 2018-based CPI also follows the 2015 Philippine Standard Geographic Classification codes.

Inflation Rate

The inflation rate (IR) is the annual or monthly rate of change of the CPI in percent. It is interpreted in terms of the declining purchasing power of money.

Source: Retail Price Survey