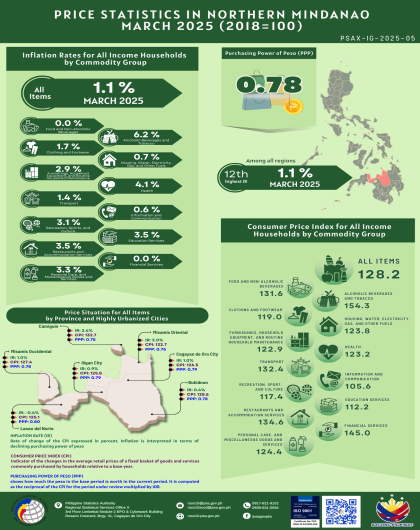

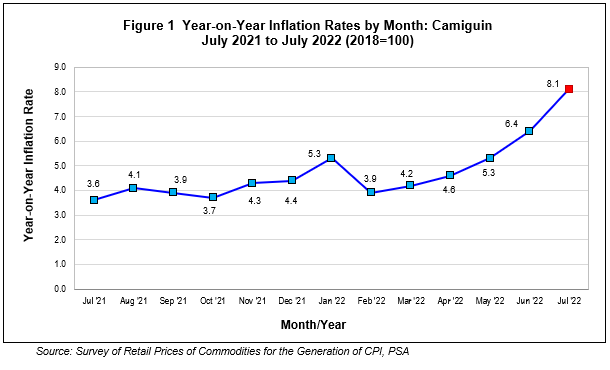

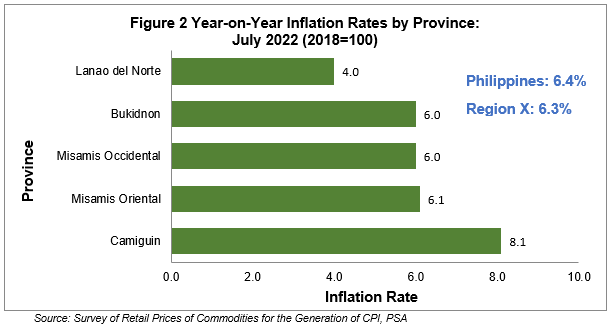

Highest annual inflation rate among the five provinces in the region was registered by Camiguin in July 2022. This was followed by Misamis Oriental at 6.1 percent which is higher than the registered rate of 5.2 percent in June 2022. On the other hand, the province of Lanao del Norte remained the province with the lowest inflation rate in the region for the month of July 2022 at 4.0 percent, although this rate is higher than its posted rate of 3.1 percent in June 2022.

A faster rate of increase was posted in the regional annual inflation rate at 6.3 percent in July 2022, higher than the registered rate of 5.5 percent in June 2022 by 0.8 percentage points. Furthermore, the national annual inflation rate in July 2022 rose further at an increment of 0.3 percentage points from its registered 6.1 percent rate in June 2022. (See Figure 2)

Figure 2 presents the annual inflation rates of the provinces in Region X in July 2022.

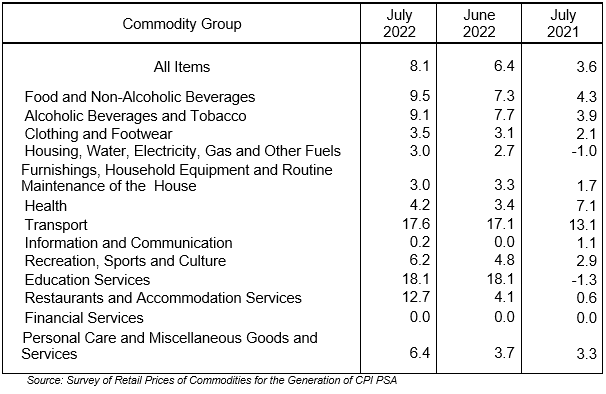

The faster rate of increase in the provincial annual inflation rate was primarily brought about by large increment in the heavily weighted food and non-alcoholic beverages at 9.5 percent in July 2022 from its posted rate of 7.3 in June 2022. Moreover, increases were also posted in the indices of alcoholic beverages and tobacco (9.1%), clothing and footwear (3.5%), housing, water, electricity, gas and other fuels (3.0%), health (4.2%), transport (17.6%), information and communication (0.2%), recreation, sports and culture (6.2%), restaurants and accommodation services (12.7%), and personal care and miscellaneous goods and services (6.4%). (See Table 1)

Table 1 Year-on-Year Inflation Rates by Commodity Group:

Camiguin (2018 = 100)

In contrast, only furnishings, household equipment and routine maintenance of the house registered a slowdown at a slower rate of 3.0 percent in July 2022. Furthermore, financial services posted no increase in its July 2022 inflation rates.

An increase of 2.2 percentage points was registered in the provincial food index in July 2022 from its posted rate of 7.5 percent in June 2022. Foremost reason for this increase were the large increments posted in the indices of flour, bread and other bakery products, pasta products and other cereals (5.4%), meat and other parts of slaughtered animals (9.7%), fish and other seafood (18.8%), milk, other dairy products, and eggs (31.2%), oils and fats (9.3%), fruits and nuts (31.8 %), vegetables, tubers, cooking bananas and pulses (2.4%), sugar, confectionery and desserts (19.0%), and ready-made food and other food products not elsewhere classified (6.0%).

On the other hand, slower rate of decline was posted in the index of rice at -0.9 percent in July 2022 compared with the decline of -1.8 percent in June 2022. (See Table 1a, p. A-1)

(Sgd.) FRANCISCO C. GALAGAR JR.

Chief Statistical Specialist

Technical Notes

This Special Release presents the results of the Survey of Retail Prices of Commodities and Services for the Generation of Consumer Price Index (CPI) conducted in July 2022.

CPI

The CPI is an indicator of the change in the average retail prices of a fixed basket of goods and services commonly purchased by households for their day-to-day consumption relative to a base year.

Uses of the CPI

As an indicator, the CPI is most widely used in the calculation of the inflation rate and purchasing power of the peso. It is a major statistical series used for economic analysis and as monitoring indicator of government economic policy.

The CPI is also used as a deflator to express value series in real terms, which is, measuring the change in actual volume of transaction by removing the effects of price changes. Another major importance of the CPI is its use as basis to adjust wages in labor management contracts as well as pensions and retirement benefits. The CPI also serves as inputs in wage adjustments through the collective bargaining agreements.

Components of the CPI

- Base Period

This is a reference date or simply a convenient benchmark to which a continuous series of index numbers can be related. Since the CPI measures the average changes in the retail prices of a fixed basket of goods, it is necessary to compare the movement in previous years back to a reference date at which the index is taken as equal to 100.

The present series uses the 2012 as the base year. The year 2012 was chosen as the base year because it is the year when the Family Income and Expenditure Survey (FIES) was conducted. The FIES is the basis of the CPI weights.

- Market Basket

Market basket refers to a sample of thousands of varieties of goods purchased for consumption and services availed by the households in the country. It was selected to represent the composite price behaviour of all goods and services purchased by the consumers.

- Weighting System

The weighting system is a desirable system that considers the relevance of the components of the index. For the CPI, the weighting pattern uses the expenditures on various consumer items purchased by households as a proportion to total expenditures.

- Geographic Coverage

CPI values are computed at the national, regional, and provincial levels, and for selected cities. A separate CPI for NCR is also computed.

- Classification Standards

The 2012-based CPI series is the first in the series that used the 1999 United Nations Classification of the Individual Consumption According to Purpose (COICOP) in determining the commodity groupings of the items and services included in the market basket. The 2012-based CPI also follows the 2015 Philippine Standard Geographic Classification codes.

Inflation Rate

The inflation rate (IR) is the annual or monthly rate of change of the CPI in percent. It is interpreted in terms of declining purchasing power of money.